Explore Trusted Providers Offering Efficient Offshore Banking Services Globally.

Explore Trusted Providers Offering Efficient Offshore Banking Services Globally.

Blog Article

Unlock International Wealth Administration With Offshore Banking

The intricacies of worldwide money demand an advanced understanding of offshore financial and its potential to enhance worldwide wide range monitoring. By leveraging offshore accounts, individuals can not only shield their possessions but likewise navigate the ins and outs of tax obligation optimization and personal privacy.

Recognizing Offshore Banking

Offshore financial stands for a calculated financial option for individuals and services looking for to handle their possessions with better versatility and safety and security. An overseas bank is a financial organization situated outside the account owner's country of residence, commonly in jurisdictions recognized for positive regulatory settings. These financial institutions generally offer a variety of services, including interest-bearing accounts, financial investment chances, and financings, customized to meet the varied demands of their customers.

One crucial facet of overseas financial is the legal framework that regulates these establishments. Many offshore financial institutions operate under rigorous regulations, making certain conformity with worldwide regulations while safeguarding the personal privacy and possessions of their customers. This lawful framework can offer a protective layer against political and financial instability in an account holder's home country.

Moreover, overseas financial can facilitate global deals, enabling customers to carry out business throughout borders easily. This facet is particularly valuable for migrants, international business owners, and constant tourists. Understanding the details of offshore banking, including both the prospective advantages and the regulatory demands, is important for anybody considering this financial avenue. With educated decision-making, customers can properly take advantage of offshore financial to improve their economic techniques.

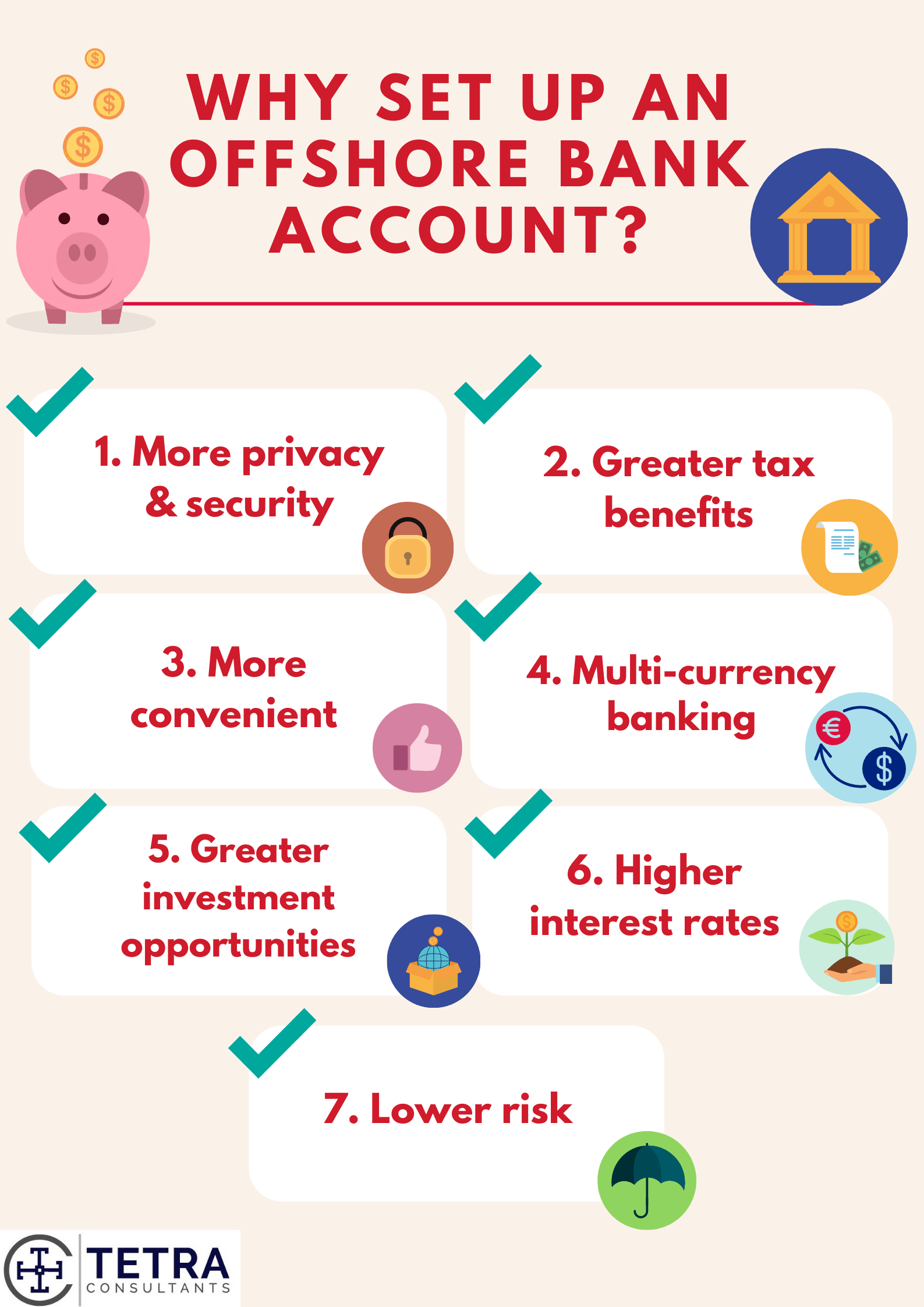

Advantages of Offshore Accounts

Among the various financial methods available, offshore accounts use several distinct advantages that can considerably enhance an individual's or service's economic administration. Among the key benefits is possession security; offshore accounts can work as a secure against political instability, economic downturns, or lawful disputes in the account owner's home country. This protective layer is especially attracting high-net-worth people looking for to maintain their wide range.

Additionally, offshore accounts commonly provide improved privacy. Lots of jurisdictions have stringent confidentiality legislations that limit the disclosure of account information, enabling clients to preserve a higher degree of financial discernment. This personal privacy can be essential for those seeking to secure delicate monetary information.

An additional substantial advantage is the capacity for tax optimization. Depending on the territory, individuals and companies may take advantage of positive tax obligation rates or perhaps tax obligation exemptions, enabling much more efficient wealth buildup.

Choosing the Right Jurisdiction

Picking the proper territory for an overseas account is an important choice that can affect the effectiveness of the financial benefits previously outlined. Jurisdictions differ in terms of regulatory structures, tax effects, and degrees of personal privacy, every one of click resources which play a substantial duty in the general utility of an offshore banking technique.

When evaluating possible territories, think about factors such as political stability, economic atmosphere, and the reputation of the financial system. Countries recognized for robust monetary services, such as Switzerland, Singapore, and the Cayman Islands, frequently offer a safe and personal financial experience. Furthermore, it is vital to examine the lawful structure regulating offshore accounts in the chosen jurisdiction, as well as any type of worldwide agreements that may affect your properties.

Furthermore, tax neutrality is an important facet to remember. Some jurisdictions offer tax incentives that can enhance the benefits of offshore financial, while others may impose rigid taxes on foreign-held possessions. Ultimately, selecting the ideal jurisdiction necessitates detailed research and perhaps the assistance of financial specialists to make certain that the chosen area lines up with your specific financial objectives and run the risk of resistance.

Techniques for Property Protection

Applying efficient methods for asset protection is necessary for safeguarding riches against possible risks such as legal claims, political instability, or economic recessions. One primary weblink method is the establishment of overseas depends on, which can supply a layer of splitting up between personal properties and potential lenders. By positioning properties in a trust fund, people can protect their riches from cases while taking advantage of desirable tax treatment in particular jurisdictions.

Another strategy includes the usage of restricted liability entities, such as offshore corporations or restricted responsibility business (LLCs) These structures can secure individual possessions from service obligations and give anonymity, making it much more tough for claimants to accessibility individual wide range.

Diversity of properties across numerous jurisdictions is also crucial. Holding financial investments in several countries can mitigate threats associated with any kind of solitary economic situation's downturn. Additionally, purchasing concrete possessions, such as actual estate or rare-earth elements, can supply additional security against money decline and inflation.

Lastly, routinely assessing and upgrading possession security techniques in feedback to transforming legislations and personal scenarios is crucial - offshore banking. Positive monitoring of riches ensures that people stay prepared for unpredicted challenges in an ever-evolving global landscape

Steps to Open Up an Offshore Account

First, conduct detailed study to recognize an appropriate offshore jurisdiction. Aspects to consider consist of regulatory stability, banking online reputation, and tax implications. Popular options frequently consist of Switzerland, Singapore, and the Cayman Islands.

Following, choose an economic establishment that satisfies your requirements. Evaluation their solutions, charges, and account types. It's sensible to select a financial institution with a strong track record for customer support and safety.

Once you have actually picked a bank, you will require to collect the required paperwork. offshore banking. Commonly, this includes evidence of identity (such as a key), proof of address, and financial declarations. Some financial institutions may likewise call for a referral letter or a resource of funds affirmation

After constructing your records, send your application, ensuring it is total and precise. Be gotten ready for a due diligence procedure, which may include interviews or extra paperwork requests.

Verdict

By employing efficient methods for protecting properties and understanding the procedural actions to establish an overseas account, capitalists can navigate the complexities of worldwide money. Inevitably, overseas banking stands for an effective device for accomplishing financial safety and development in an increasingly interconnected globe.

Report this page